A Closer Look at the Luxury Real Estate Market in Watch Hill, Weekapaug, and Coastal Connecticut

Introduction

Every summer, as I watch families stroll down Bay Street or gather on the beaches of Weekapaug, I’m reminded of why so many people fall in love with this area. For years, I’ve had the privilege of helping clients from New York, Connecticut, Massachusetts, and beyond secure their own place along this remarkable stretch of the southern Rhode Island and eastern Connecticut coastline.

But this season, one question keeps coming up in nearly every conversation I have with buyers:

“Should I buy now, or wait for mortgage rates to drop?”

It’s a fair question - especially in a market where prices are high, inventory is limited, and mortgage rates have been more volatile than usual. The answer isn’t the same for everyone, but what’s happening nationally - combined with the unique dynamics of our local luxury market - makes it an important conversation to have.

Where Mortgage Rates Are Headed

Mortgage rates have been on everyone’s mind lately. After a weaker-than-expected jobs report earlier this summer, rates briefly dipped to 6.55% - their lowest point so far this year. While that may not sound dramatic, in today’s market, even a small drop reignites buyer interest.

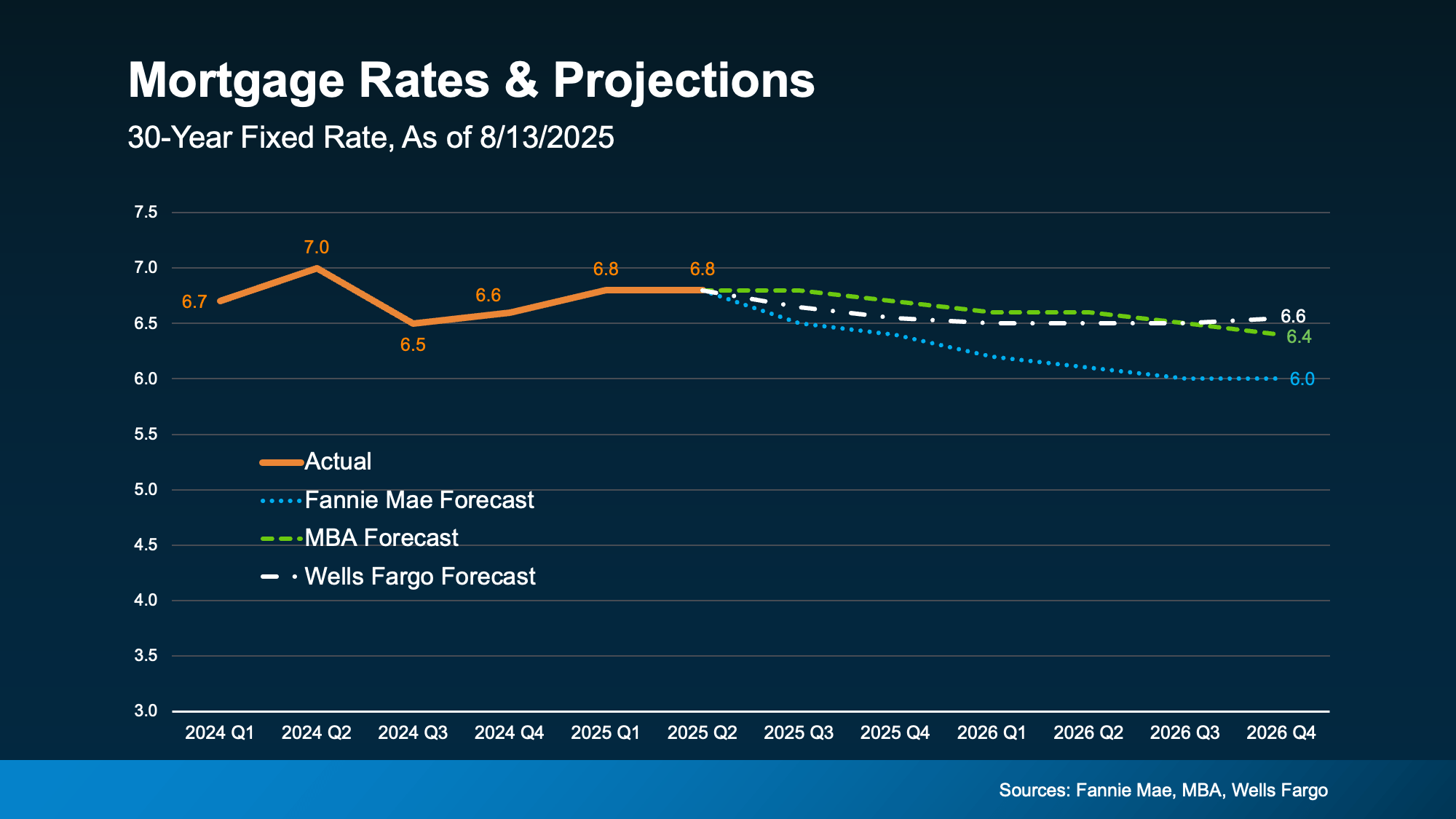

However, experts don’t expect a sharp fall anytime soon. According to recent forecasts (see graph below), most analysts - including Fannie Mae, Freddie Mac, and the Mortgage Bankers Association - project rates to remain in the mid-to-low 6% range through 2026.

That means we’re unlikely to see a return to the sub-4% rates of the past anytime soon. There will be fluctuations along the way, but the overall expectation is stability, not steep declines.

The “Magic Number” Buyers Are Watching

One figure comes up repeatedly in conversations: 6%.

According to the National Association of Realtors (NAR), if rates hit that threshold:

- 5.5 million more households could afford the median-priced home

- Roughly 550,000 buyers are likely to enter the market within 12–18 months

In other words, when rates reach 6% - which Fannie Mae expects could happen next year - a flood of pent-up demand could be unleashed. That means more competition, fewer available properties, and rising prices, especially in markets with limited inventory like Watch Hill and Weekapaug.

What This Means for Watch Hill, Weekapaug, and Beyond

Here’s where our local market differs from many others. Along our coastline - from Watch Hill to Mystic - we have:

- Extremely limited inventory: There are only so many properties in these small, historic villages, and new development is rare.

- Consistent demand: Buyers from NYC, Fairfield County, Westchester, and Boston return year after year seeking a summer home, an investment, or a family retreat.

- Generational ownership: Many homes are passed down rather than listed for sale, keeping available inventory low.

Because of this, the relationship between interest rates and pricing here is different from other markets. While lower rates do increase competition, our supply shortage often drives pricing even in slower national environments.

The Tradeoff: Buying Now vs. Waiting

So, what’s the right move? Let’s break it down:

Buying Now

- Less buyer competition - many people are waiting on the sidelines

- Greater negotiating leverage with sellers who are motivated today

- More inventory to choose from before demand spikes again

- Potential to refinance later if rates eventually fall

Waiting for Lower Rates

- Possible savings on monthly payments if rates drop

- But risk of higher home prices, especially in desirable locations

- More buyers entering the market all at once, reducing negotiating power

- Smaller selection of available properties

For luxury and secondary home buyers in our area, the “waiting game” carries a unique risk: by the time rates fall meaningfully, the home you want could be gone - or significantly more expensive.

Why Timing Matters More Here

Watch Hill, Weekapaug, and Stonington aren’t like other markets. Properties here are highly individual - the right porch, the right sunset view, the right walk to the beach - and many never come back once sold.

I’ve seen it happen many times: a buyer hesitates, expecting rates or prices to shift, and six months later, the property they loved is gone. In a market like ours, where scarcity defines value, the cost of waiting is often greater than the cost of slightly higher borrowing today.

Looking Back to Look Ahead

Having spent my childhood summers in Watch Hill and now helping families secure their own piece of this coastline, I’ve seen decades of steady appreciation. Yes, there have been ups and downs nationally, but over time, the trend here has always pointed upward - especially for homes near the Village, the beach, or along the waterfront.

That long-term stability is what draws many secondary homebuyers to this market. Even when broader economic factors create uncertainty, this area’s lifestyle appeal and limited inventory make it remarkably resilient.

A Smart Strategy for Today’s Buyers

If you’re considering buying a secondary home in Watch Hill, Weekapaug, Charlestown, Stonington, or Mystic, here are a few practical takeaways:

- Focus on the property, not just the rate. Exceptional homes are rare here. Waiting for a small rate shift may cost you the perfect fit.

- Run the numbers on refinancing. Buying now doesn’t lock you into today’s rates forever - you can refinance later if rates drop meaningfully.

- Consider your lifestyle goals. A summer home isn’t just an investment; it’s where you’ll build memories. Delaying that enjoyment has its own cost.

- Be ready when the right property appears. In a tight-inventory market, having financing pre-arranged and a strategy in place can make all the difference.

Bottom Line

If mortgage rates drop meaningfully, demand for properties along our coastline will spike - and prices are likely to follow. If you’re hoping for less competition, better negotiating power, and more selection, that window exists now.

This isn’t about rushing into a decision; it’s about making an informed one. Every situation is unique, and the right strategy depends on your goals, timeline, and budget. But if you’ve been watching the market, now may be the time to take a closer look at what’s available - before the next wave of buyers arrives.

If you’d like to discuss the market, upcoming inventory, or how these national mortgage trends affect our area, I’d be happy to connect. Whether you’re ready to buy now or simply weighing your options, I’m here as a resource.